south dakota property tax records

Butte County Offices are closed all Federal Holidays. Payment is required at time of service.

South Dakota S 10 Safest Cities Of 2022 Safewise

All special assessments are due in full on or before April 30.

. South Dakota real and personal property tax records are managed by the County Assessor office in each county. Taxes that accrue in 2008 are due payable in 2009 Tax notices are mailed by mid-February. The county register of deeds office can most appropriately be thought of as a library of local records.

Ad See Anyones Property Records History. South Dakota Real Property Taxes In South Dakota the median property tax rate is 1288 per 100000 of assessed home value. These records can include Pennington County property tax assessments and assessment challenges appraisals and income taxes.

This office is a storage facility for a host of local documents. The fee for the search is 2000 plus a fee for copies whether emailed or hard copy. The tax base in Brown County is just over 4 billion.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. Fast Easy Access To Millions Of Records. Up to 38 cash back Property Tax Records.

Any person may review the property assessment of any property in South Dakota. They are maintained by various government offices in Charles Mix County South Dakota State and at the Federal level. If your taxes are delinquent you will not be able to pay online.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. If you are unable to visit our office a last document search request may be made by email or phone and will be conducted as time permits. Determining tax exempt status for applicable properties.

Uncover Available Property Tax Data By Searching Any Address. This value is reflected to the market value in which most people would likely pay for a given property in its present condition. This is done using mass appraisal techniques.

To find out information about a specific piece of property you must contact the county where the property is located. ViewPay Property Taxes Online. South Dakota Property Tax Breaks for Retirees.

Belle Fourche SD 57717. South Dakota law requires the equalization office to appraise property at its full and true value as of November 1 of each year. They are a valuable tool for the real estate industry offering.

Pennington County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Pennington County South Dakota. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property.

Continuing to educate the public on the South Dakota tax system. First half property taxes are due by April 30 th. The South Dakota Property Tax Division maintains information on property taxes including real property taxes in South Dakota.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. Determining the taxable value of approximately 25000 parcels. From land title transfers to birth marriage and death records this office has a wealth of information about the local population.

Tax Records include property tax assessments property appraisals and income tax records. Property assessments are public information. Spink County Government Redfield SD 57469.

Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year. Second half are due by October 31 st. Email the Treasurers Office.

128 of home value. Real Estate taxes are paid one year in arrears. Type Any Name Search Now.

Spink County Redfield South Dakota. Click here for the latest information on motor vehicle titling and registration. If you are a senior citizen or disabled citizen property tax relief applications are available through our office and our staff can assist you in filling out these forms.

Custer County collected more than 10 million in real estates taxes in 2008. The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information. 104 N Main Street.

State Summary Tax Assessors. Convenience fees 235 and will appear on your credit card statement as a separate charge. About Assessor and Property Tax Records in South Dakota.

A few South Dakota County Assessor offices offer an online searchable database. Our property records tool can return a variety of information about your property that affect your property tax. Office hours are Monday Friday 8 am to 5 pm.

A South Dakota Property Records Search locates real estate documents related to property in SD. Ad Property Taxes Info. Please call the Treasurers Office at 605 367-4211.

Land and land improvements are considered real property while mobile property is classified as personal property. Searching Up-To-Date Property Records By County Just Got Easier. Please take the time now to visit the rest of our Website where you will be able to learn about other areas of our county.

Office phone is 605-892-4456. Renew Your Vehicle Registrations Online. Property owners may review the information that the county office has on.

Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. However it does not have access to individual tax records. Property Tax Assessment Process.

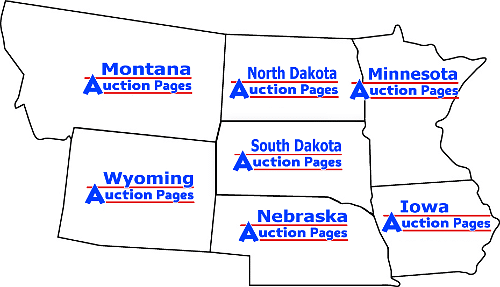

The second half of property tax payments will be accepted until October 31 without penalty. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. Tax amount varies by county.

South Dakota is ranked number twenty seven out of the. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. An individual will receive instructions and assistance on the Index books.

Please contact the Treasurers Office at 605 472-4583 for more information on income. South Dakota Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in SD.

Property Tax South Dakota Department Of Revenue

North Dakota Sales Tax Small Business Guide Truic

South Dakota Estate Tax Everything You Need To Know Smartasset

About The State Of South Dakota South Dakota Secretary Of State

South Dakota Economy Britannica

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Compare Sales Income And Property Taxes By State Us Map 2011 Property Tax Map Us Map

South Dakota Student Loan Forgiveness Programs

Co2 Proposals That Include Pipelines In South Dakota And Iowa Spark Eminent Domain Discussion

Property Tax South Dakota Department Of Revenue

What Is Food Insecurity Feeding South Dakota

South Dakota And Sd Income State Tax Return Information

South Dakota S 10 Safest Cities Of 2022 Safewise

.png)

Maps South Dakota Department Of Transportation

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts